Understanding Net Worth: How to Calculate and Improve Your Financial Health

Net worth is a crucial financial metric that can help you assess your financial health. It is the difference between your total assets and liabilities. In simpler terms, it is the amount of money you would have left if you sold all your assets and paid off all your debts. Knowing it can help you make informed financial decisions and plan for the future.

Calculate net worth

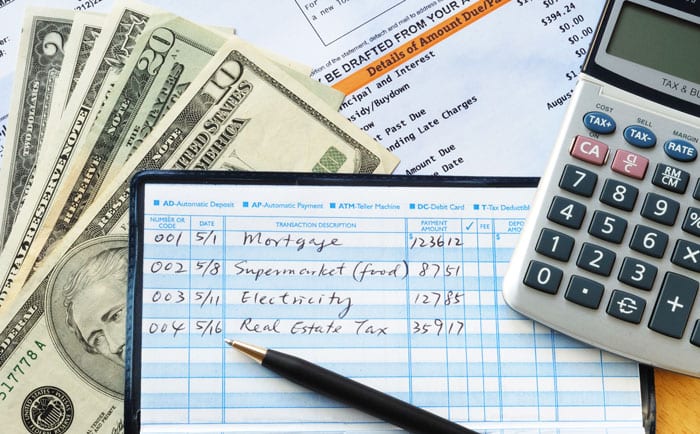

To calculate it, start by listing all your assets, including cash, investments, real estate, and personal property. Then, subtract all your liabilities, such as credit card debt, student loans, and mortgages. The result is your net worth. If your assets exceed your liabilities, you have a positive worth. If your liabilities exceed your assets, you have a negative worth. Improving it requires a combination of increasing your assets and decreasing your liabilities.

You can increase your assets by saving more money, investing wisely, and earning more income. You can decrease your liabilities by paying off debt, avoiding unnecessary expenses, and living within your means. By doing so, you can steadily increase it over time. It’s important to note that it is not the only indicator of financial health. It’s just one piece of the puzzle. Other factors to consider include your income, expenses, savings rate, and credit score. However, tracking it can provide a clear picture of your overall financial situation and help you make informed decisions about your money.

Conclusion

In conclusion, it is a valuable tool for assessing your financial health. By calculating your net worth and taking steps to improve it, you can achieve greater financial stability and security. Remember that improving your it takes time and effort, but the rewards are well worth it in the long run.